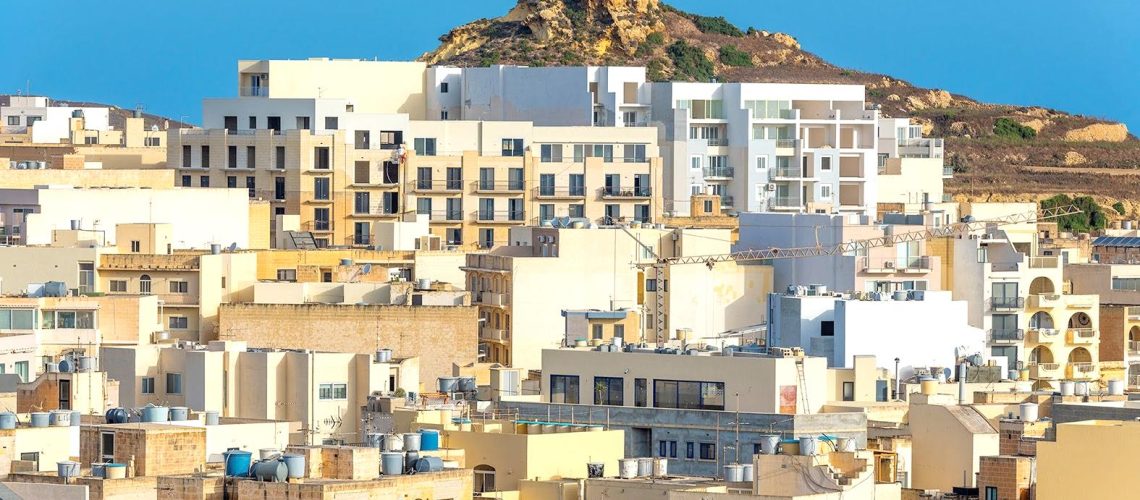

The government will remove a tax incentive for property purchases in Gozo in Monday’s Budget, in a bid to slow down the construction frenzy on the island.

The move could provide rare reprieve for an island which has been facing relentless construction projects in the last number of years, sparking protests among Gozitan residents and environmentalists.

That stamp duty will go back up to 5% as it is in the rest of the country, government sources confirmed with Times of Malta.

The sale and purchase of properties in UCAs will remain tax-free.

The idea was put forward to the government ahead of the budget by an alliance of seven environmental, economic and social organisations and entities in Gozo, collectively called Għal Għawdex.

The organisations – the Gozo Business Chamber, Din L-Art Ħelwa Għawdex, Għawdix, Wirt Għawdex, the Gozo Tourism Association, the Gozo University Group and the Gozo Regional Council – urged the government to remove all fiscal incentives on sale of land and property for development into apartments.

In its pre-Budget proposals, the Gozo Business Chamber spelled out the problem.

“While the blanket 2% tax on the purchase of property in Gozo was beneficial at a point when the market was stagnant, such a blanket measure as it is currently formulated is incentivising the development of small apartments concentrated into massive projects, within communities that cannot currently absorb such type of development,” it said.

The scheme was first announced in the 2017 budget speech, slashing stamp duty on Gozo property purchases from the standard five per cent to two per cent, to push more economic activity in Gozo.

It was introduced for one year but has since been extended each year.

NSO data shows that by 2019 the deeds for property in Gozo more than doubled, only slightly declining during the pandemic and then picking up pace again in the past couple of years.

In its proposals for last year’s budget, the Gozo Regional Development Authority (GRDA) acknowledged the scheme increased property sales in Gozo but warned it could generate “unintended adverse consequences”, more so because it is open to all types of properties including apartments, irrespective of price, and does not distinguish between first or second-time buyers or other buyers.

It is also not tied to the buyer being based in Gozo, the GRDA said. It could, therefore, be “distorting the market by subsidising and encouraging haphazard and excessive holiday or buy-to-rent property development with possible repercussions to Gozo’s delicate environment and long-term economic consequences”.

More than 13,000 vacant or seasonally used dwellings

NSO data from the latest census also revealed there are more than 13,000 seasonally used or vacant dwellings in Gozo, more than half of which are flats and penthouses.

Nearly half of the dwellings (45%) are secondary, seasonally used or vacant, although this figure is slightly less than the one recorded in 2011.

In a Times of Malta pre-Budget event held on Tuesday, Caruana said Budget 2024 will be all about “prioritisation”.

Government sources confirmed on Saturday the Budget will retain energy subsidies, increase pensions, cost-of-living adjustment and the minimum wage and retain the other existing schemes and fiscal incentives.

Article Source: Times of Malta