Legal Letting Requirements

Are you considering renting out your apartment or house in Malta? Thanks to the current booming economy and increasing demand for quality properties, there has never been a better time to invest in buy-to-let properties.

If you do invest in a rental property, it is important that you also take into consideration the legal requirements, in terms of Licences, VAT, Tax implications and EPC. The following information should help regarding legal requirements, however, please always refer to the respective authorities, Email or Contact us for more details.

Income Tax on Long Term Property Lettings

Owner/Landlords have two options of what tax procedure to follow:

- pay a flat rate of 15% as final tax on the gross rental income; or

- pay at the progressive tax rates, less the deductions provided for by Maltese tax legislation, which include any ground rent paid on the property, licence fees and interest on loan and a further deduction equal to 20% of the net rental income.

Owners of more than one property must tax all the properties at the same option.

Income tax on Short-Stay Property Rentals

Holiday rentals refer to the rental of a property for short periods, usually for furnished premises for any period less than 6 months. In such instances, tax is payable on the net rental income. This is determined after deducting any expense incurred in the production of income derived from such activity, given that upon demand, the taxpayer would be in a position to present to the Inland Revenue Authorities supporting documentation. Deductible expenses include amongst others, license fees, ground rent payable on the property, as well as renovation and maintenance costs.

Tax is payable according to the tax progressive rates applicable to the individual. One may also qualify for a preferential rate of 15%, applicable on rental income up to

€12,000, with any additional rental income being charged according to the tax progressive rates.

VAT Implications

Owner/Landlords in Malta are not required to charge VAT. Exceptions to this rule include:

- letting for the purposes of holiday or short let accommodation, in which case the chargeable rate is 7%.

- letting of property by a limited liability company to another tax-registered person to carry out an economic activity. VAT chargeable on such transaction will be 18%..

Licenses Required

The process to obtain this license is a simple one, which would also require that a representative from MTA visits the property to vet its conformance to standards. Subject to fulfilling the quality requisites, the license will be issued at a nominal fee. The landlords are normally also required to be VAT registered, bar some exceptions:

- Landlord has applied for the citizenship scheme, otherwise known as the Malta Individual Investor Programme (MIIP)

- would have signed an employment contract for at least one year. Therefore, the tenant will be working on the Maltese Islands with proof of contract for a year or more.

- is a student who has joined a university course which is longer than one year.

- has been in Malta for a minimum period of 12 months.

- holds a Maltese ID Card or Passport

The above-mentioned information should help, however, please always refer to the respective authorities for clarification on legal requirements, or contact a member of our property letting team for more details.

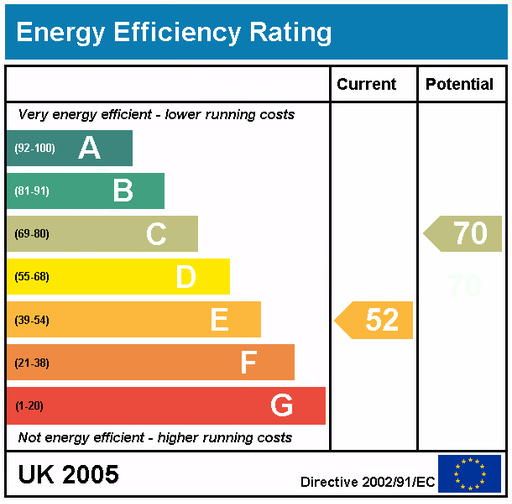

Energy Performance Certificate (EPC)

An EPC is required whenever a property is built, sold or rented out. Only qualified and registered assessors may prepare an EPC.

An EPC is required whenever a property is built, sold or rented out. Only qualified and registered assessors may prepare an EPC.

The purpose of an EPC is to provide information on a property’s energy use and typical energy costs and to make recommendations about how to reduce energy usage and increase efficiency.

It is the responsibility of a Landlord or vendor to arrange an EPC to give to prospective buyers or show to tenants.

An EPC Report typically costs between €200-€350 Euros depending on the service provider. This includes the BRO (Building Regulations Office) fee for registering the Certificate. EPC’s are valid for 10 years.

For more information you may visit the EPC government website or call the BRO helpline on (00356) 2292 7343